Posted on 10/06/2021

As deaths increased, the coronavirus pandemic (COVID-19) took almost everyone by surprise and in early 2020, the US federal government under then President Donald Trump acted quickly to flood the US economy with a cash bazooka, while increasing the Federal Reserve’s balance sheet. At the onset of the pandemic lockdowns, U.S. businesses began to accumulate cash and cut spending. In March 2020, the Fed cut interest rates to near zero and launched a series of bond buying programs. These quantitative easing measures have enabled companies to raise capital at very low cost. In fact, the US Department of the Treasury has used its Foreign Exchange Stabilization Fund to capitalize a number of credit facilities. Debt was easy to contract with bond investors, while bank debt was not as attractive.

In the face of panic as COVID gene therapy vaccines were being tested at that time as part of Operation Warp Speed, US companies began to accumulate cash by increasing investor debt, cutting costs and by restructuring operations. Overall, with more money printing and corporate discipline, US businesses have started increasing their bank deposits without taking more bank loans overall.

Lower net interest margin on average

Banks love big deposits, as long as they can use the money to make loans. However, bank lending has slowed down sharply as large corporations have been able to appeal to yield-hungry investors at lower interest rates. Some bank executives tiptoed up and asked some customers to take loans, spend money, go to other smaller banks, or slow down their deposits. Data from the Federal Reserve shows that total loans were equivalent to 61% of all deposits as of May 26, 2021, up from 75% in February 2020. Banks measure the success of income with a metric called the net interest margin. Simply put, the net interest margin is a measure of the difference between the interest income generated by banks and the amount of interest paid to their lenders, relative to the amount of their assets. According to the Federal Deposit Insurance Corporation, the net interest margin fell to an all-time high in the first quarter of 2021. Don’t be sad for all banks, some posted record profits in the first quarter of 2021 thanks to non-revenue. interests of activities. like stock trading, IPOs and even the creation of SPAC. In an even more promising scenario for banks, if and when interest rates rise, they will be in a better position for the line of credit portion of the income equation.

“The banking sector reported positive results for the first quarter of 2021, reflecting optimism about the pace of the economic recovery. However, a record net interest margin and slow loan growth could challenge banks going forward, â€President Jelena McWilliams said in a recent FDIC periodic report.

As these companies expanded their liquidity, some were willing to invest in money market funds, fund investments and even Bitcoins like Tesla, Inc., Square and Microstrategy. The majority of CFOs at large US companies were cautious about liquidity, even choosing not to maximize return but liquidity. Many large American companies have moved to operate with a higher cash balance for almost a year.

It’s cause and effect time now. Big banks face a rule that they hold capital equivalent to at least 3% of all assets. The Federal Reserve temporarily excluded reserve balances and US Treasury securities from the denominator of the additional leverage ratio (SLR) in April 2020, knowing that the influx of money would impact banks. In March 2021, this regular ratio calculation reverted to its original formula. So, banks have warned regulators that increasing cash deposits with lower loans could force them to raise more capital or say no to deposits.

Put your money in money market funds

At the end of 2020, executives of large banks began discussions with large corporate clients to transfer expired cash funds from deposits to money market funds. Money market fund assets are treated differently under bank capital rules, relieving some of the regulatory pressure on banks in their capital requirements. According to the Investment Company Institute, flows to US money market funds surged in 2021, bringing total assets to US $ 4.61 trillion, slightly below the record set in May 2020. The flow of The money in money market funds has caused these funds to find new places to move this new money. Due to the very low interest rates, money market funds have stored cash backs to the Federal Reserve overnight in a facility that pays them zero return and have been largely ignored for the past three years. Intended to be temporary, the Federal Reserve created the Overnight Repo Facility (ON RRP) in 2014 to improve its control over the rate of federal funds, interest rate banks and government-funded companies. bill each other for unsecured and mostly day-to-day loans. Funds held overnight with the Federal Reserve Bank of New York surged in May 2021 to a record high of $ 497.4 billion. Some analysts believe that figure could reach $ 1,000 billion.

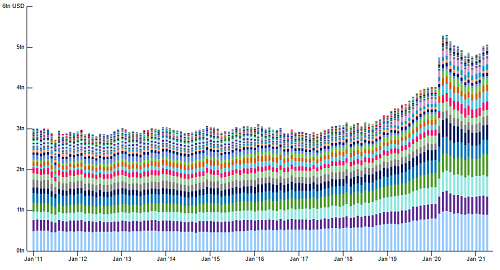

Investments of any US money market fund

Total investments by category of US money market funds

Sources: SEC Form N-MFP2, OFR Analysis

LINK: https://www.financialresearch.gov/money-market-funds/

Note: All data presented are aggregates derived from the OFR based on the ultimate parent of the original source data. Updated May 18, 2021 with data through April 30, 2021.

Keywords: Federal Reserve System.